European Food Tech: a Recap

It’s been two weeks since the IPO of Takeaway.com, the Dutch food delivery logistics service. Europe now has several public and private well-funded food tech companies. This makes researching and benchmarking the sector all the more interesting. Time for a recap of European food tech.

Since 2011, about €4 billion has been invested in European food tech (takeout, delivery, shopping, production, restaurant reviews and table bookings). The largest food tech rounds occurred mostly in 2014 and 2015, after which the market consolidated (to an extent) and focused on execution.

This excludes capital raised by global transport and logistics players such as Uber, Amazon (and Google).

Raising Capital: Public or Private Track?

Traditionally, a core argument for going public was access to capital. Nowadays, it is far from clear whether public or private companies have easier access to large amounts of growth capital. Based on the below chart, comparing total funding, private companies have had more access to capital.

The recent announcement of a potential $100 billion mega-fund by SoftBank and Saudi Arabia’s sovereign wealth fund further underscored the point that private capital is abundant. Therefore, the remaining rationale for going public is to provide liquidity to existing shareholders; something to consider for investors in public tech stocks!

Valuation Data

Takeaway.com’s IPO priced at €23 per share. Currently the stock is trading around €24 (market cap is around €1 billion). By comparison, UK firm Just Eat went public in April 2014 at a valuation of GBP 1.5 billion and is currently valued at GBP 3.7 billion. Just Eat currently trades at roughly 9.5x 2016 Revenues and 32x 2016 EBITDA. Takeaway.com is similarly priced at around 10x 2016 revenues.

There have been several acquisitions in food tech. Transaction multiple data is sparse, but this data table contains transaction multiples sorted by revenue multiple.

Preliminary Performance Data

The below chart shows the relative market position of key players in Takeaway.com’s markets based on web visits only (as per SimilarWeb). A few takeaways (no pun intended) from this map:

- UK is by far the largest market, more than twice the size of Germany, Austria and Switzerland combined (and seems to have matured most).

- Takeaway.com leads in Benelux and is a significant player in Germany (but not a leader in any large market)

- Deliveroo is overtaking smaller players in many markets and well on its way achieving scale in its markets

We will soon follow up with more data in additional markets. We will also be comparing mobile app data. Once Takeaway.com comes out of its so called blackout period we will be able to review equity research as well, which will help us to compare more data.

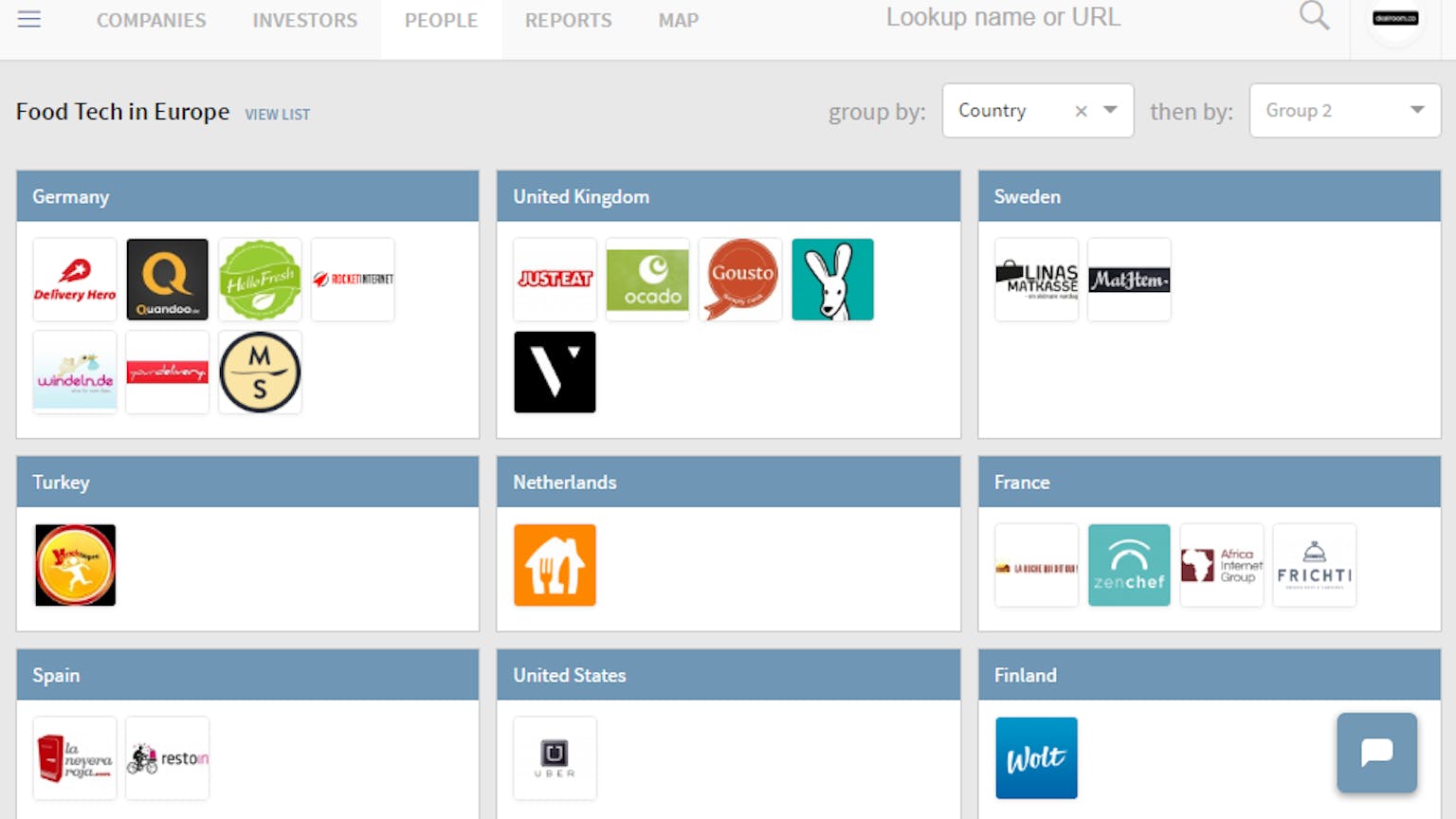

Finally, below a list of selected European Food Tech leaders. Adjacent categories also include merchant tools (restaurant payments such as Velocity, loyalty such as Zenchef) and AgriTech.

All Food Tech data in this post:

- Companies in Europe (and beyond)

- Funding rounds ranked by size and ranked by date

- IPOs

- Strategic Acquisitions

- Exits ranked by date and ranked by EV / sales multiple

- AgriTech companies