European VC funding: up, down or sideways?

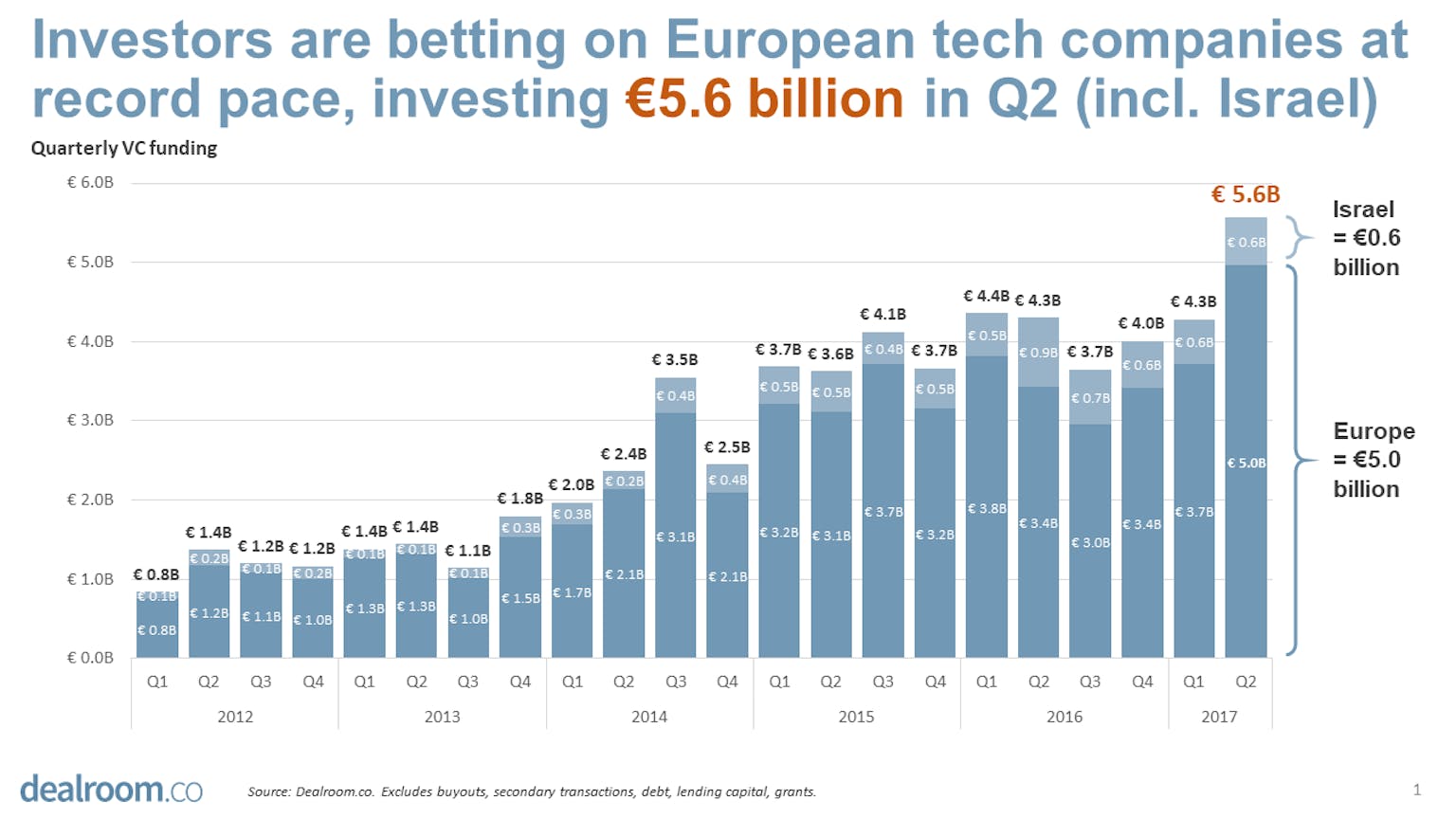

Last week, Dealroom released its European venture capital report for Q2 2017. It showed a record €5.0 billion raised by European companies, and €5.6 billion when including Israel (download Dealroom’s full 2017 Q2 VC report). The chart below shows that the 50 or so largest rounds (out of more than 750 rounds) already accounted for nearly €3.5 billion in funding. The remaining 700 or so rounds bring the total to €5.0 billion, a record.

Subsequently, other reports came out by other vendors with a very different narrative. KPMG, for instance, released a global analysis of venture funding showing Q2 VC funding at only €3.5 billion in total (PDF) and said:

“A fifth straight quarterly decline in deals volume, however, total VC investment in Europe remained strong as a result of a number of mega-deals. Three $100 million+ deals together accounted for $1 billion in European VC funding, including $502 million to London-based Improbable, $397 million to Berlin-based Auto1 Group, and $100 million to London-based GammaDelta Therapeutics.” (via Business Insider)

The following slide shows Dealroom Data and the KPMG data side-by-side. KPMG data shows the quarterly number of rounds would have roughly halved in the last 3 years, while total funding doubled. This would imply 300% growth of average deal-size. Dealroom data shows a roughly 50% increase in average deal size (which is still very significant).

This is despite the fact that Dealroom does not include most of the $397 million (€360 million) to Auto1 Group as it was largely debt funding from a consortium of investment banks. Also *not* included in Dealroom numbers are: secondary transactions (trading of existing shares), debt rounds, funding of outside tech companies (such as telecom) and companies that moved to the USA.

Interestingly, Q2 was also a record when excluding top-3 or top-10 rounds, as the following chart shows:

Dealroom data does show a decline in the number of rounds but only in the last two (not five) quarters (additional technicality: total of rounds in the last quarters might still go up, as seed rounds are often reported after a successful series-A raise).

The KPMG data has led some to pronounce that the bubble is deflating. How to interpret the Dealroom data then? Dealroom data demonstrates that investors are in fact betting on European tech companies at record pace. The outcome of these bets is to be determined years from now.