Finally Online: Europe’s 500 Most Prominent Venture Capital Investors

Back in April, Dealroom published a preliminary ranking of Europe’s 500 most prominent venture capital investors (see April post). The ranking has already been published by Business Insider, Corriere della Sera, and many others. Feedback and input was received from numerous VCs.

Now this ranking is finally online!

This means you can now search & filter the list by criteria such as location, industry experience, country experience, location. Here are just some examples of what is possible:

- Top investors in Poland (or Madrid)

- Seed stage investors based in the U.S. (but investing in Europe)

- Investors with experience in Poland (or Latvia)

- Top investors in the Netherlands with travel tech experience

- Top corporate investors in France (or Europe)

Over 10,500 investors were reviewed for this top ranking: funds, corporate investors, angels, accelerators and crowdfunding platforms. The rankings per country are as follows:

| Country | #1 | #2 | #3 | #4 | #5 |

|---|---|---|---|---|---|

| All | Index Ventures | Holtzbrinck Ventures | Balderton Capital | Northzone | Lakestar |

| United Kingdom | Index Ventures | Balderton Capital | Atomico | DN Capital | General Atlantic |

| Germany | Holtzbrinck Ventures | Rocket Internet | High-Tech Gründerfonds | Wellington Partners | Acton Capital Partner |

| Israel | 83North | Carmel Ventures | Pitango Venture Capital | Jerusalem Venture Partners | OurCrowd |

| France | Oleg Tscheltzoff | IdInvest | Partech Ventures | 360 Capital Partners | Xavier Niel |

| Sweden | Northzone | Creandum | Industrifonden | Investment AB Kinnevik | Vostok New Ventures |

| Switzerland | Lakestar | Redalpine | Novartis Venture Fund | Swisscom Ventures | Ringier |

| Spain | Nauta Capital | Caixa Capital Risc | Ysios Capital | Cabiedes & Partners | Jose Marin |

| Ireland | Enterprise Ireland | Atlantic Bridge | Kernel Capital | AIB Seed Capital Fund | Delta Partners |

| Netherlands | Newion Investments | Endeit Capital | Prime Ventures | INKEF Capital | Arthur Kosten |

| Finland | Nokia Growth Partners | Lifeline Ventures Oy | Inventure | Conor Ventures Partner | Tekes |

| Belgium | GIMV | Hummingbird Ventures | Capricorn Venture Partners | PMV | Fortino |

| Italy | Innogest Capital | P101 | United Ventures | L-Venture Group | Italian Angels for Growth |

| Norway | Verdane | Investinor | Schibsted Media Group | Alliance Venture | Viking Venture |

| Denmark | Sunstone Capital | Seed Capital Denmark | Bonnier | Danish Growth Fund | Novo A/S |

| Austria | Speedinvest | Austria Wirtschafts service | Rene Giretzlehner | Alfred Luger | Florian Gschwandtner |

| Poland | MCI Management | RTAventures | Innovation Nest | Experior Venture Fund | Hedgehog Fund |

All the received input and feedback from numerous venture capital firms has been reflected. But you can still provide us with info as we will keep updating the ranking regularly.

Below is an FAQ based on the questions we’ve received.

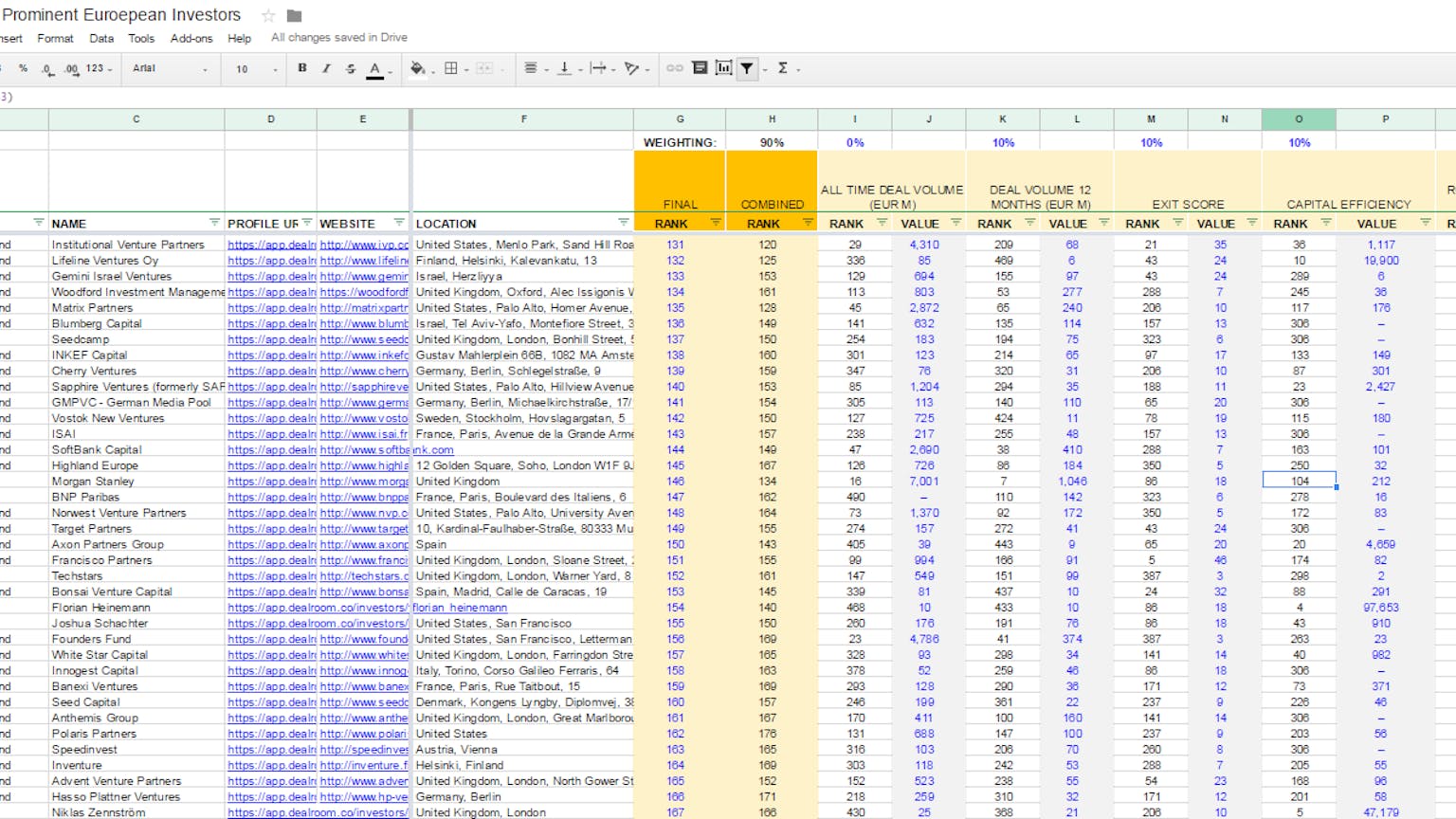

- How is the ranking calculated?

The ranking is based on nine different indicators which look at: investment activity, current portfolio size and quality, and (successful) exits. See bottom of this blog post for more detail on the nine indicators. - What is the goal of this ranking?

The main goal is to make it easier to see which investors you should consider in various cases such as:

– A founder looking for capital

– An investor looking for co-investors

– A corporate M&A team looking for VC portfolios to explore

– An LP exploring and comparing different funds

A secondary goal is to have a logical way to sort results. Dealroom counts over 6,500 tech investors active in Europe. After sorting by relevance, most circumstances require the dataroom to have a secondary way to sort results. - How can I improve my ranking?

Firstly, we need to make sure all data is up to date (check online here). You can contact us or you can register for free, claim your account and add data directly yourself or ask us to update.

- How can I provide feedback on the methodology?

We welcome feedback on methodology and will consider it carefully. You can write us here or reach out via Twitter. - Why did you include corporate funds and rankings?

We deliberately made the ranking as inclusive as possible, because the lines between investor types are blurring. If anything, angels and corporates are at a disadvantage. The list enables you to filter any way you like: to show investment funds only use this filter. - Our fund is still new, so we are at a disadvantage

Track-record is a key attribute for any investor’s standing in the world. The ranking wouldn’t be complete without measuring it. New funds are inherently at a disadvantage in this respect. However, Dealroom is contemplating another future ranking of first-time funds. - Is the ranking based on Europe only?

Emphasis is placed on European investments, activity and performance (see full methodology at the bottom). The location of the investor was not a factor, so the ranking includes many U.S. based investors. - Investor X is a top performing fund. Why is it not ranked higher?

The ranking is not a purely performance-based, but performance does play a big role. Firstly, information on investment returns is highly imperfect. Secondly, while performance is the most important measure for LPs, it is not the only thing that counts for many other stakeholders. For example, Scottish Equity Partners is a fund with an exceptional track-record, but happens to have been less active during the last year and therefore isn’t ranked as prominently as one might expect.

Ranking methodology

The ranking is based on the following nine indicators, each with equal weighting:

- Portfolio size in Europe = number of portfolio companies in Europe (incl. Israel), all time

- Number of rounds in last 12 months = number of rounds which investor participated in during last 12 months

- Deal size in last 12 months (€ millions) = total aggregate size of rounds which investor participated in during last 12 months

- Exit score = number of exits relative to total portfolio, all time

- Exits number = number of exits, global

- Number of exits > €100 millions (total firm value, all time)

- Number of exits > €500 millions (total firm value, all time)

- Number of portfolio companies valued over €500 millions, all time

- Capital efficiency = total € amount of all exits relative to the € amount of capital invested (total of rounds which investor participated in, all time)

If you have any other questions, please contact us on Twitter.