Europe’s top Unicorn hunters

iZettle’s acquisition by PayPal means yet another big European exit for investors including: Creandum, Dawn, Index, 83North, Northzone, Zouk, and others (by the way, iZettle also has many corporate investors: Intel Capital, MasterCard, Santander, and American Express as iZettle’s Dealroom profile show).

Recently also Taxify, Darktrace and Revolut joined the unicorn club while Benevolent AI moved up in value.

Time to update our unicorn investor league tables. Index Ventures is still comfortably at the top, with nine unicorns including iZettle (so, soon eight). But there are 20 more investors with at least two unicorns in their portfolio:

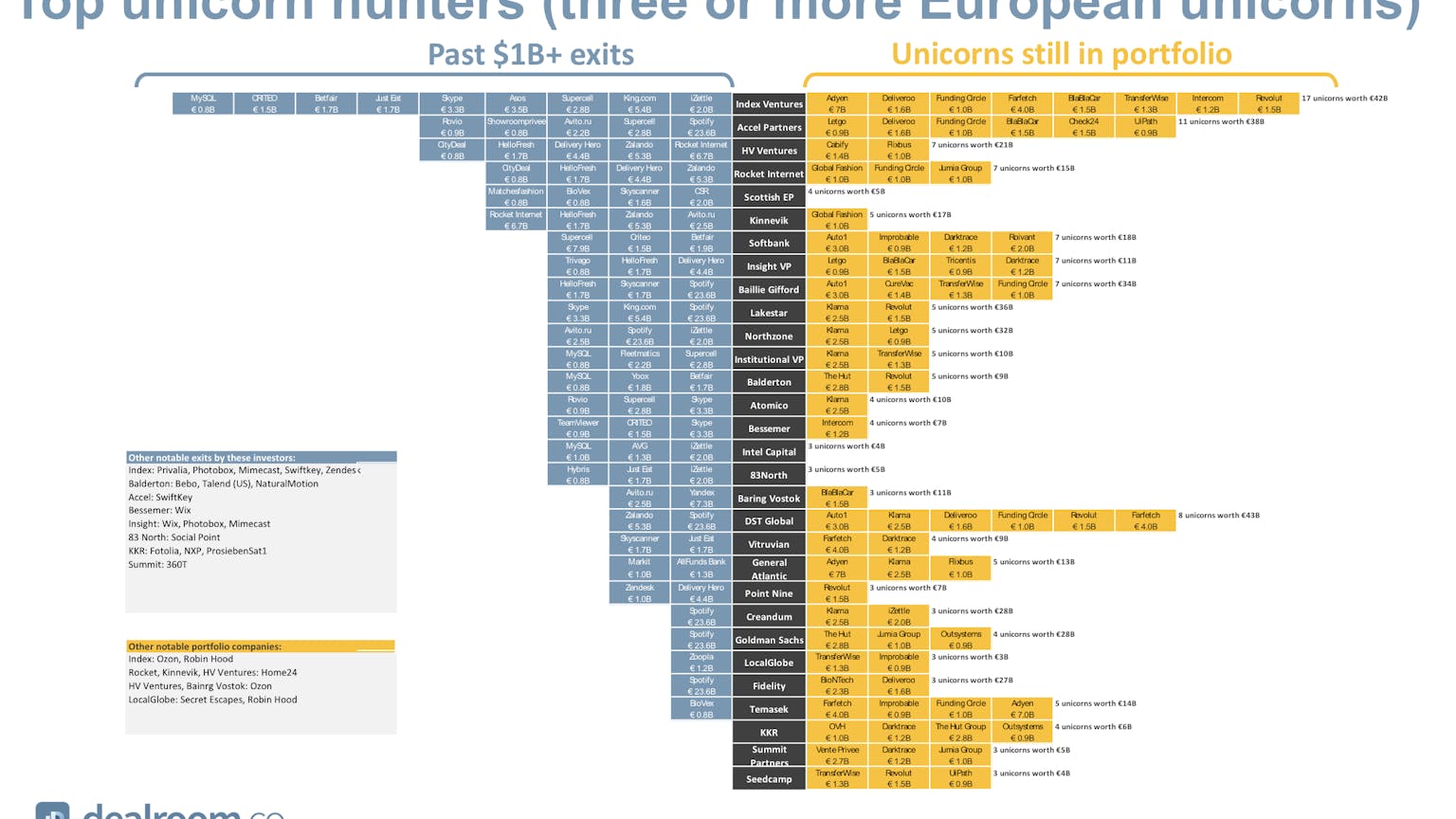

What about past performance? The below chart combines past performance with future outlook. This chart shows investors with at least three European unicorn investments in total (past or current). 28 investors are listed here. The list is dominated by many known tier-one VC firms, plus late stage firms like Softbank, Temasek, Baillie Gifford, and DST Global. But two seed stage investment firms stand out: LocalGlobe and Seedcamp.

Of course, investing early in these companies is more impressive than investing in an already established company. What if we would weigh early investments differently? The below chart does exactly that, using a very simple and admittedly arbitrary adjustment factor of 2x for early investments (Series A, B,) and 3x for seed investments. Late stage investments (Series C and after) are weighted 1x.