Making sense of the e-scooter & micro-mobility surge

It’s only barely been over a year since the electric scooter craze began with Santa Monica-based Bird, which raised its Series-A in October 2017. Below is a list of e-scooter deals that happened in the last three months alone:

- dott €20M Seed (Amsterdam)

- Hero Electric $22M Late VC (New Delhi)

- Wind Mobility $22M Seed (Berlin)

- Voi Technology $50M Series A (Stockholm)

- TIER Mobility €25M Series A (Berlin)

- unu $12M Series B (Berlin)

- Grin Scooters $45M Series A (Mexico City)

- Be Group $100M Seed (Vietnam)

Investment in micromobility startups exceeded €1 billion in 2018 as the below interactive chart shows:

€1 billion global e-scooter investment

(tip: switch to quarterly view)

Is investor discipline deteriorating? Or is there method to the madness? The debate on Twitter is lively. Some of the venture capital industry’s top firms are backing e-scooters who have been around for a long time. Stakeholders include not only venture capital firms, but also ride sharing platforms, the mobility industry more generally and most importantly, entire cities.

The bull-case for e-scooters is quite simple. Ever expanding cities need to reduce congestion and air quality needs to improve for cities to remain liveable. The size of the potential market is huge. Consumers spend over $1.1 trillion a year on transportation. Car ownership (including fuel and maintenance) still takes up over 90% of that amount. That’s likely to change due to a mix of car sharing, better public transport, new ownership models, ride hailing and microbility. Even the car industry itself anticipates that (urban) mobility will drastically change. A report by ING Bank forecasts peak car by 2022.

Mobility: $1.1 trillion European spending

So city transportation is in dire need of modernisation, and many cities seeem willing to facilitate big changes. But in the end, consumers are in the driving seat. With the surge in e-scooters just a year old, important questions remain unanswered:

- How fast will e-scooter hardware depreciate? (vandalism, theft, carelessness)

- Might e-scooters become a commodity? (through direct ownership models)

- What will happen during winter? (i.e. how severe is seasonality?)

- How will cities treat e-scooter platforms? (i.e. regulation)

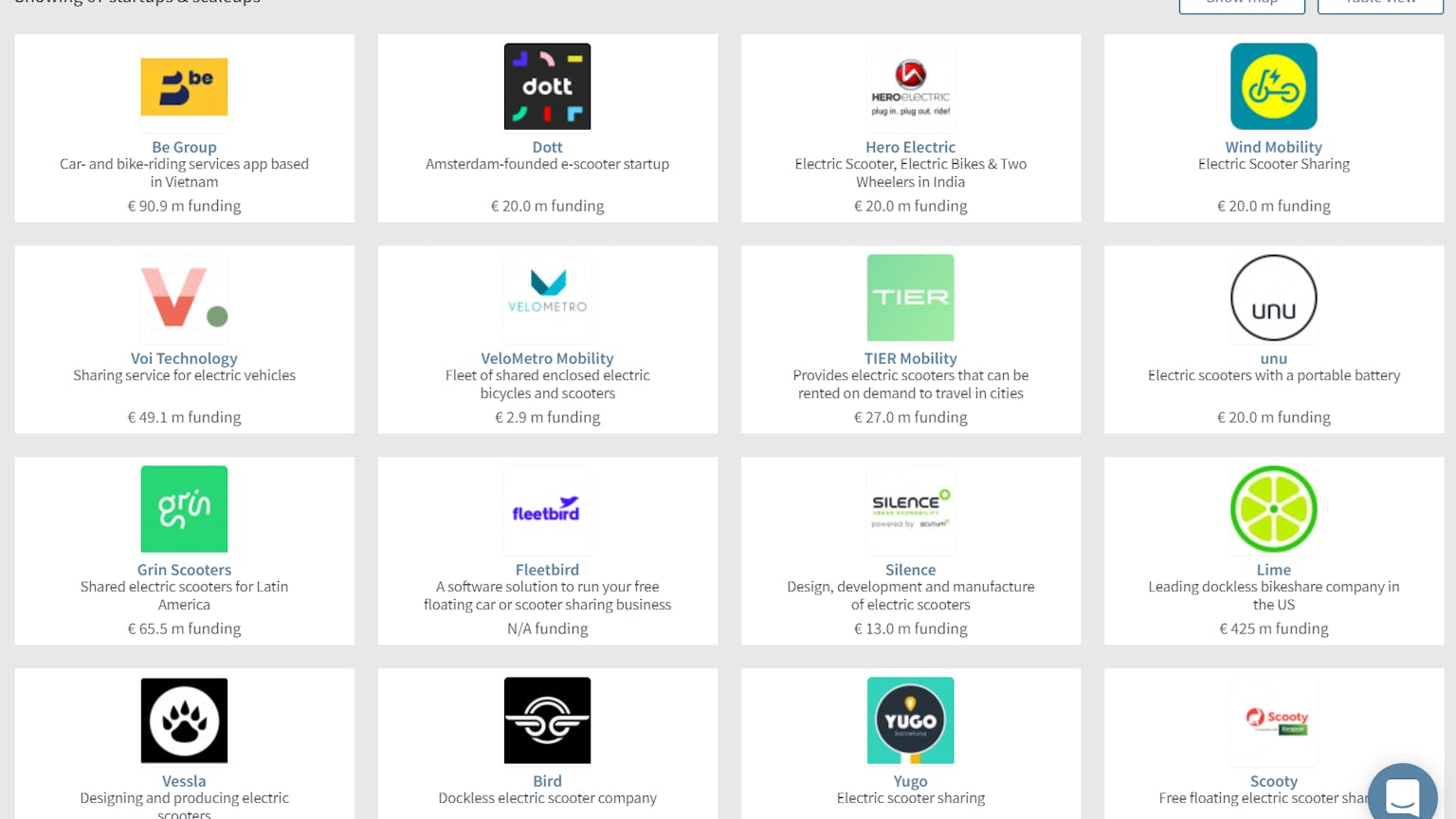

Options have increased dramatically, as the below image shows.

Warren Buffett once made an important point, using airlines as an example:a market revolution can still take place without investors benefiting from it.

Mobility: more consumer options

For a more complete list of e-scooter startups check the Dealroom.co database (tip: click on grid view for the below view).