Naspers’ $100 billion re-listing on Amsterdam Stock Exchange: everything to know

Naspers, a ~$100 billion market cap company, this week announced that it will re-list most of the company from Johannesburg to Amsterdam.

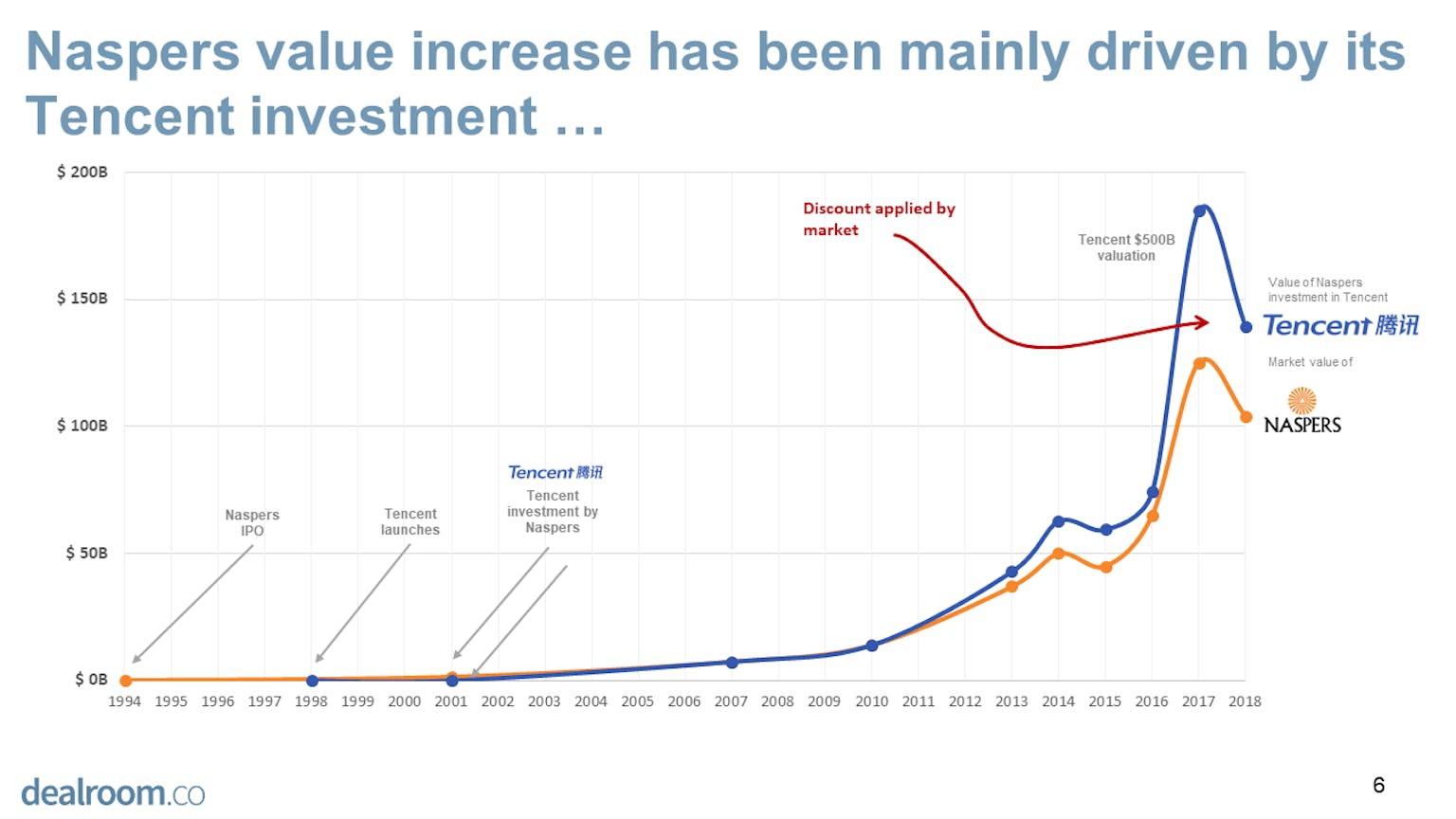

Imagine running a company that’s owning assets worth $180 billion but somehow the stock market values your company at “only” $100 billion. How do you close that $80 billion gap? That’s the challenge faced by Naspers’ management. The sheer magnitude of a $80 billion valuation gap is hard to really grasp. That’s the total value of Booking.com, or more than two Spotifies!

The below chart shows the gap clearly (note: chart from Aug ’18, still fairly accurate).

After the re-listing, its traditional South African media assets will remain listed in Johannesburg (mainly Pay TV, worth about $8 billion). But its international internet assets will be listed in Amsterdam under a new entity, which will include:

- Its 31% stake in ~$500 billion giant Tencent, worth ~$150 billion

- OLX Group, the global online classifieds & marketplace giant, worth about ~$8 billion

- Food investments, including a big stake in Delivery Hero, worth ~$3 billion

- Fintech assets worth ~$2 billion

- Other investments including Mail.ru ~$2 billion

Will this initiative close the $80 billlion discount? It will solve at least one problem: Naspers had become way too big for the Johannesburg stock market. Amsterdam does offer a more liquid and accessible stockmarket, as the below chart shows:

But how much impact will this re-listing really have? Previous efforts, like extending its UK and US ADR program had little effect. A secondary listing in Hong Kong had been suggested by analysts, which would also limit part of the FX translation risk with Tencent. But Amsterdam has now been chosen, also because management is already located there.

But an issue that’s not addressed is corporate governance and voting structure: Naspers’ vote-adjusted free float is still only 28%.

Another major reason behind the discount is the gigantic capital gains on Tencent. Taxation isn’t the issue: capital gains on Tencent are tax free. Anytime access to a $150 billion piggy bank isn’t the regular way corporates are structured, and could distort incentives. After all, management needs to make big bets that are able to “move the needle”. Shareholders cannot foresee what happens to those bets and has no control over them. The only way to really address this would be a de-merger of its Tencent investment, or creating a tracking stock. But this seems unlikely to happen (perhaps Naspers likes its piggy bank).

In March 2018, for the first time ever, Naspers sold 2 percent of its holding in Tencent for about $10 billion to invest in its new focus areas (Food Tech, Marketplaces, Payments/Fintech). Naspers said it had no plans to further reduce its holding for the next three years.

A brief history of Naspers

South African Naspers was founded in 1915 as a publisher and printer of newspapers and magazines. It was then called De Nationale Pers (in short, Naspers). The company developed into a media conglomerate when in 1985 it moved into the pay-TV business, through M-Net which became a leading pay-TV service in Sub-Saharan Africa.

In 1994, Naspers went public, at a valuation of roughly $200 million. In 1997 it founded internet service Mweb. That same year Koos Bekker was appointed as CEO, after successfully leading the pay-TV business. In 2001 Naspers (with Koos Bekker as CEO) invested $32 million in Tencent for a 46.5% stake. This deal may be one the best investments ever, as Tencent subsequently became China’s leading internet company (alongside Alibaba) and is now worth nearly $500 billion. At the time however, the dot-com bubble had just burst and Tencent was an unprofitable Chinese operator mainly known for instant messaging platform QQ.

An acquisition & investments spree

With confidence boosted, Naspers went on to pursue many more internet deals. In January 2007, Naspers acquired 30% shares of Mail.ru Group for $165 million. Today Naspers’ 28.7% stake is valued at about $1.5 billion on the Russian stock market (Mail.ru Group owns and operates multiple Russian internet assets including Mail.ru and VK).

In 2008, Naspers acquired Polish eCommerce platform Allegro through a $1.9 billion acquisition of UK publicly traded Tradus Plc which also owned assets in Switzerland, Russia, Bulgaria and Romania.

Another defining investment happened in 2010, when Naspers acquired a majority stake in global classifieds player OLX for a rumoured $40 million price. OLX had been founded four years earlier (2006) as the eBay and Craigslist alternative for the world outside of the United States, by Fabrice Grinda and Alec Oxenford. OLX raised at least $28.6 million from venture firms Bessemer, DN Capital, General Catalyst, Nexus, Founders Fund and Nexus and made several acquisitions in emerging markets. Naspers turned OLX into its main brand for global online classifieds. In 2014, Naspers increased its stake in OLX to 95%. Since then, Naspers has re-branded many of its global classifieds assets to OLX.

In 2015, Naspers acquired a majority in Avito and became the biggest investor in Letgo, thus consolidating its position as a global classifieds leader. Some of the founders have Letgo previously founded OLX.

Between 2014 and 2018 Naspers also made numerous venture investments such as SimilarWeb, Frontier Car Group, Udemy, Brainly, Codecademy, Twiggle, Kreditech and others. In 2017 Naspers became the biggest investor in the global food delivery marketplace Delivery Hero.

Naspers investments are too many to capture in one blog post but you can find most of them on Nasper’s Dealroom profile. Overall, Naspers has been a successful investor: even excluding Tencent, Naspers claims an unrealised investment return of 17% (IRR) and 2.2x on all investments (including disposals) and investment return of 23% 2.2x IRR on its current portfolio.

Naspers’ position & strategy today

Today Naspers has three focus areas: Online Classifieds, Food, and Payments/Fintech.

Most of its eCommerce activities (Allegro and Flipkart) have been sold, both at a significant profit (Flipkart at 3.6x and Allegro about 1.6x). Naspers would probably sell eMag if it found a keen buyer.

The Pay TV business will now be held in a separate South African entity, where focus lies on profitability.

In classifieds, OLX turned profitable last year and growing revenues about 30%+. That excludes Letgo, the USA/Spanish shopping app for second-hand products, where heavy investment is taking place. In August 2018, Letgo, received $500 million in funding commitment from Naspers. Founded in 2015, Letgo raised nearly $1 billion already, the majority of which from Naspers. Letgo’s ownership is separated between the USA and Europe, but it now seems likely Naspers’ effective overall ownership exceeds 50%, alongside venture firms like Insight, Accel, Northzone and many others. eBay’s USA marketplace is worth about $30-40 billion alone: this is an indication for how big Letgo could be.

More big investments can also be expected in food and fintech.

Report - Online marketplaces – entering the next phase