Sneak preview: record €5.5 billion raised by European & Israeli companies (slide-deck)

UPDATE: the full 29 page Q2 venture capital report is now available here.

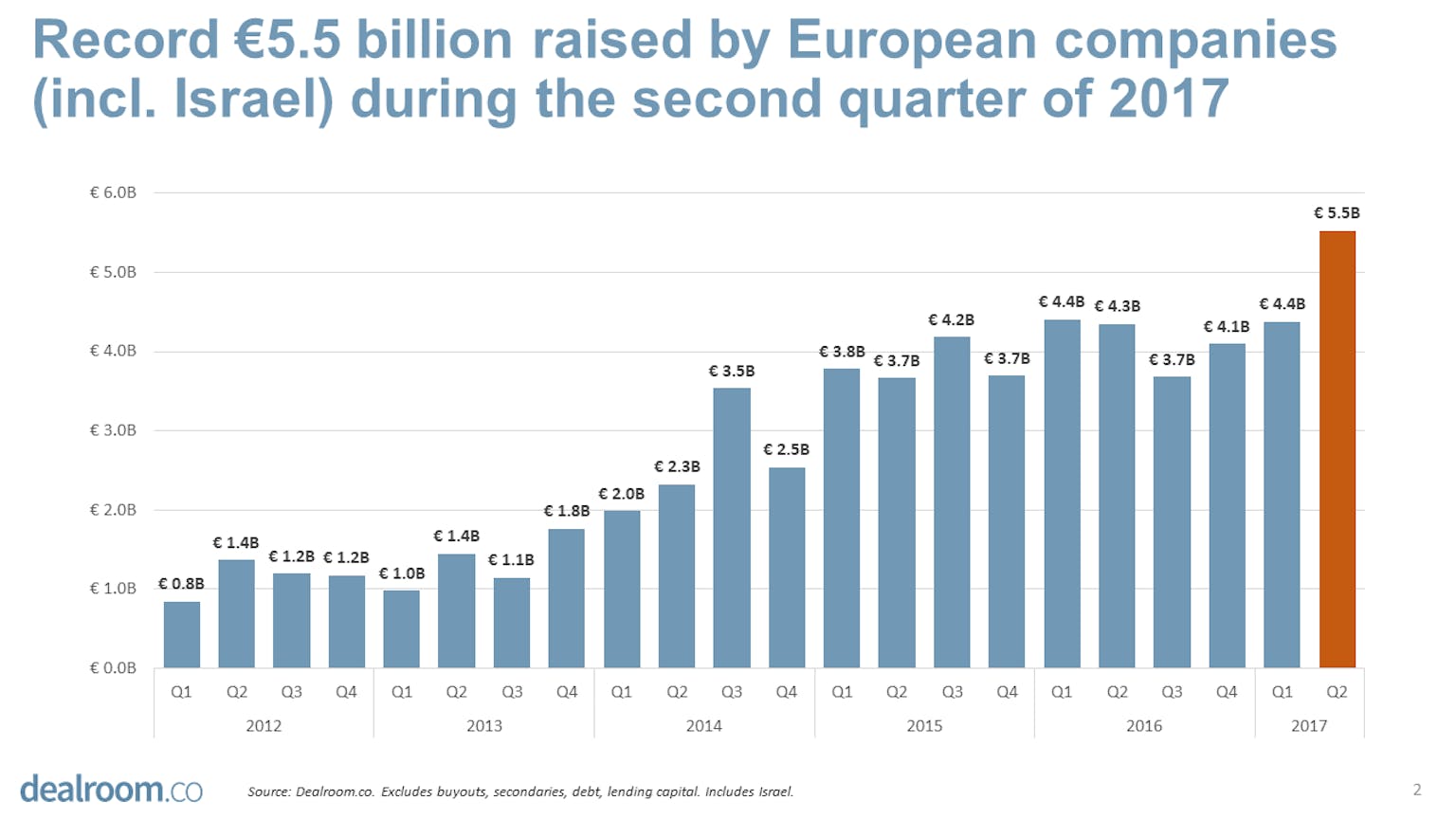

While we are still gathering data, it seems safe to say that, with more than €5.5 billion venture capital raised by European companies, this second quarter of 2017 sets an all-time record. This figure includes Israel, and excludes lending capital, buyouts, secondary transactions and debt (Auto1 Group’s €285m debt raise is excluded).

On Dealroom you can track venture capital trends in real-time. Click the image below (or here) to see the latest Q2 data with underlying rounds (or check out the funding heatmap).

The sharp growth in funding is partly driven by several mega-rounds that some would say don’t fit the traditional definition of venture (but then again, venture is evolving, just like the industries it invests in). However, even without these mega-rounds this was one of the most active quarters ever, as the following slide-deck shows.

Click on the below image or here to open the mini slide-deck:

Report - Sneak preview: record €5.5 billion raised by European & Israeli companies (slide-deck)

UPDATE: the full 29 page Q2 venture capital report is now available here.

Final note: more funding basically means more bets are being placed. The outcome of these bets will become clear in the next 10 years (some much sooner). More funding isn’t necessarily always better (as opposed to, say, GDP, sales or profit, where more is generally better). Because of this, we try (but not always succeed!) to avoid terms like “strong quarter” or “great numbers” when funding is concerned.